Tax Rate In The Philippines 2025

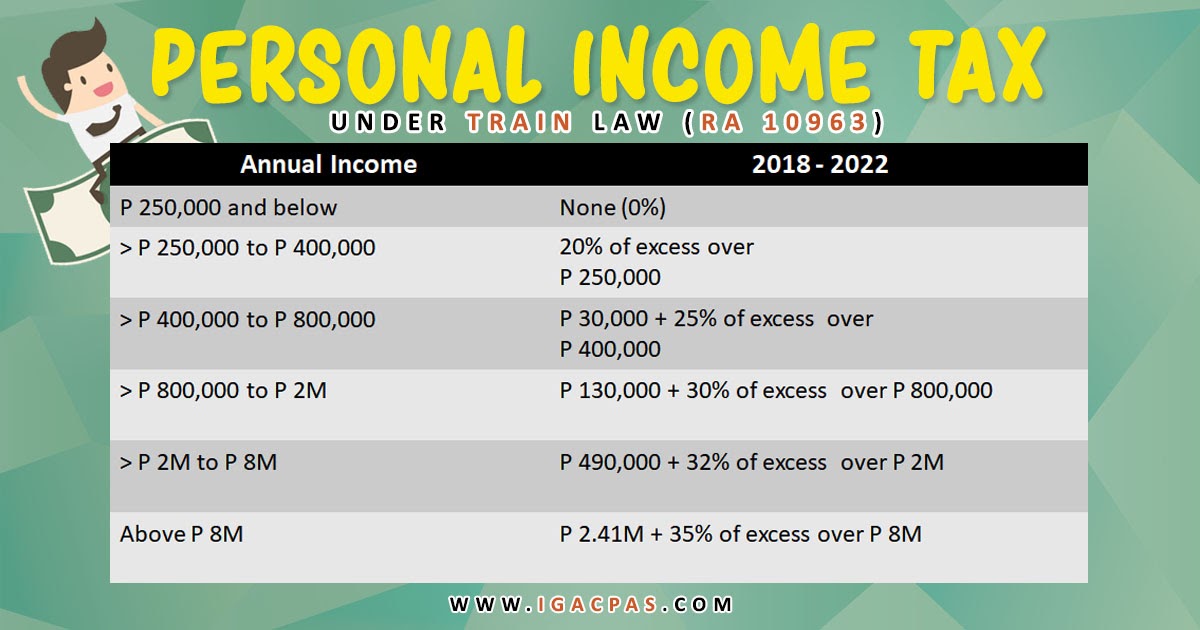

Tax Rate In The Philippines 2025. Employees with annual earnings above php 250,000 to. Train law tax table 2025.

The philippines taxes its resident citizens on their worldwide income. This bir tax calculator helps you easily compute your income tax, add up your monthly contributions, and give you your total net monthly income.

Key steps toward genuine tax reform in PH Inquirer Business, The travel tax in the. However, until june 30, 2025, the mcit is.

How To Compute Tax In The Philippines Free Calculator APAC, This bir tax calculator helps you easily compute your income tax, add up your monthly contributions, and give you your total net monthly income. How to compute income tax in the philippines in 2025 (complete guide) step 1:

Latest BIR Tax Rates 2025 Philippines Life Guide PH, Philippines income tax rates in 2025. The philippines taxes its resident citizens on their worldwide income.

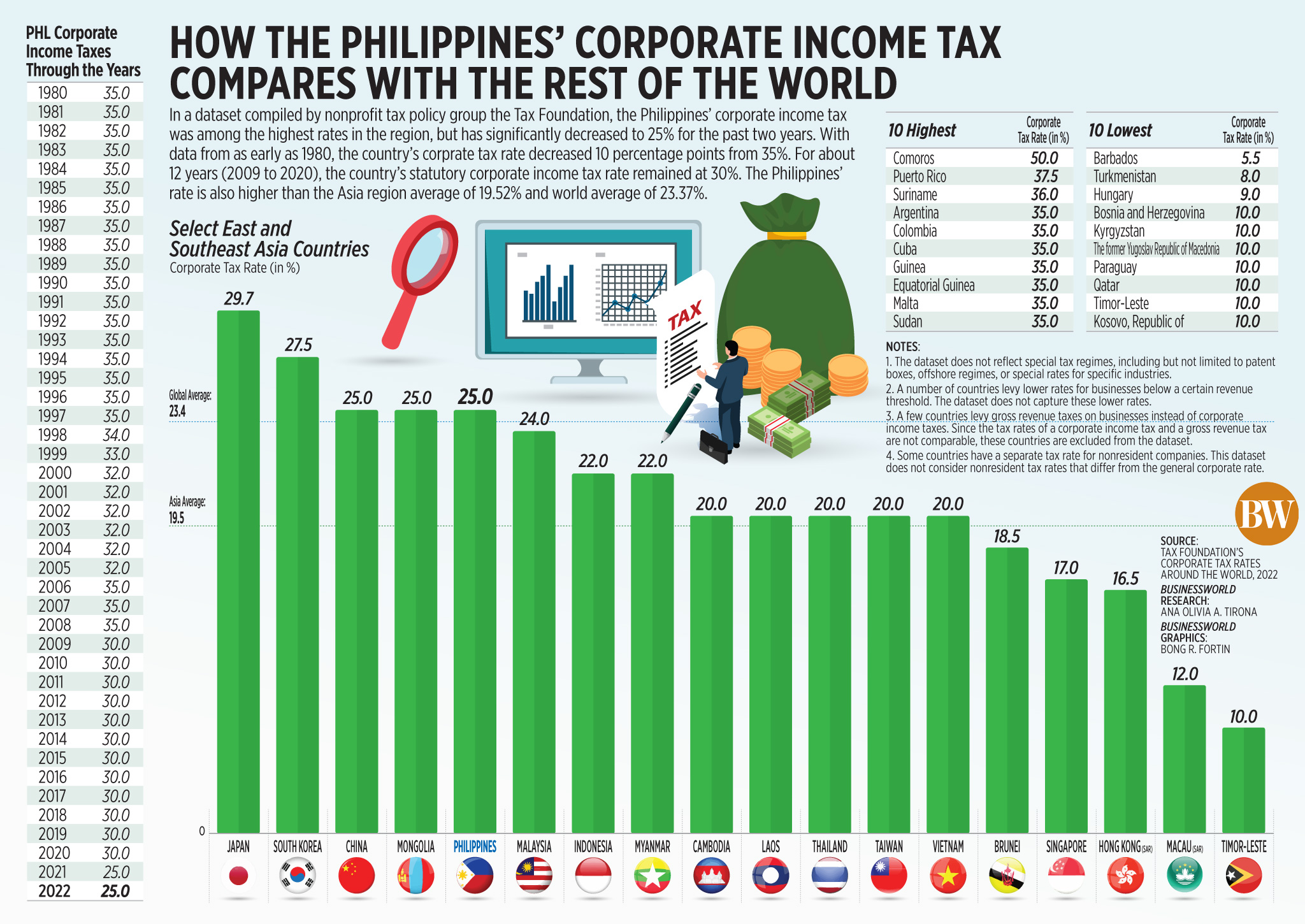

How to compute tax in the Philippines, The corporate tax rate in the philippines is 25%, with a minimum corporate income tax (mcit) of 2% on gross income. The philippines taxes its resident citizens on their worldwide income.

Tax rates for the 2025 year of assessment Just One Lap, Philippines income tax rates in 2025. Your average tax rate, calculated by dividing your total tax.

Tax Table 2025 Philippines Latest News Update, The corporate income tax rate is 25% while the minimum corporate income tax (mcit) is 2%. How to compute income tax in the philippines in 2025 (complete guide) step 1:

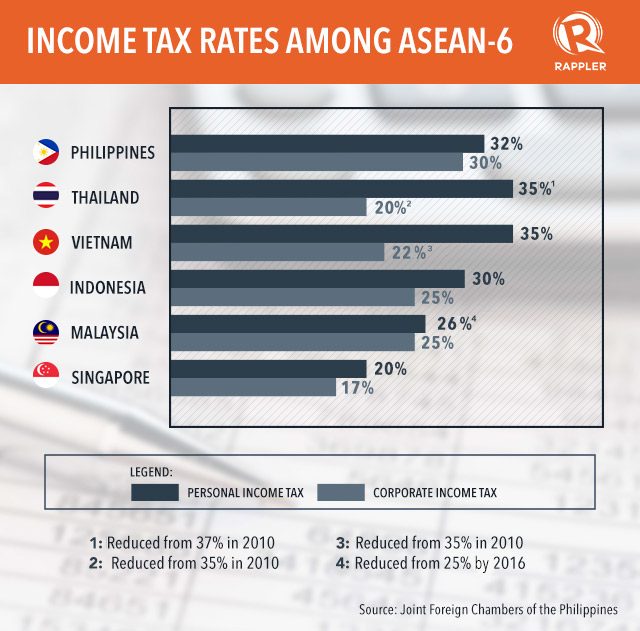

Why PH has 2nd highest tax in ASEAN, To determine your travel tax, it’s essential to know that rates vary depending on your destination, ticket class, and traveler category. While vietnam drastically reduced its.

How the Philippines’ corporate tax compares with the rest of the, The corporate tax rate in the philippines is 25%, with a minimum corporate income tax (mcit) of 2% on gross income. Employees with annual income up to php 250,000 (or php 20,833 monthly) are still exempt from paying income tax.

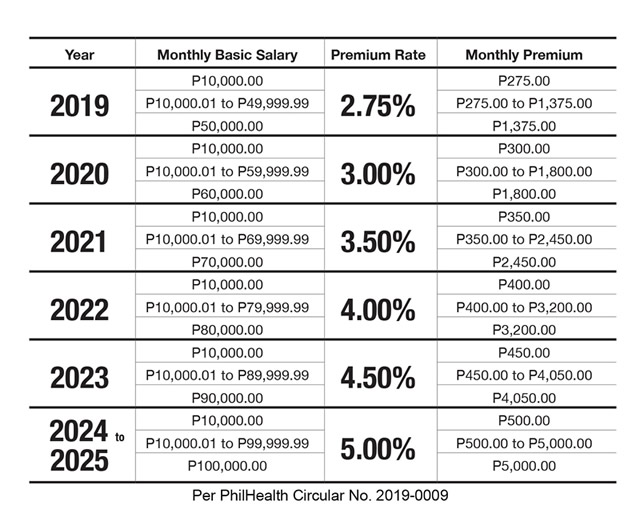

PhilHealth Contribution Table for Employees and Employers, “thailand in 2010 reduced its personal income tax rate to 35% from 37% and its corporate income tax rate to 20% from 35%; This means that those with higher incomes than php 8,000,000.00 will pay tax at a rate.

Philippine Personal Tax Rates (2018) Ines Gopez Amarante and Co., Your average tax rate, calculated by dividing your total tax. This means that those with higher incomes than php 8,000,000.00 will pay tax at a rate.

Meanwhile, a foreign corporation with a branch in the philippines is subject to taxation on the income generated in the country.